China's merger and acquisition market slows in 2016 following a record setting 2015, cooled by new policies on state-owned enterprises and tighter regulatory oversight on merger and acquisition deals. The exception to the trend was cross-border M&A, which look set to a record year in 2016.

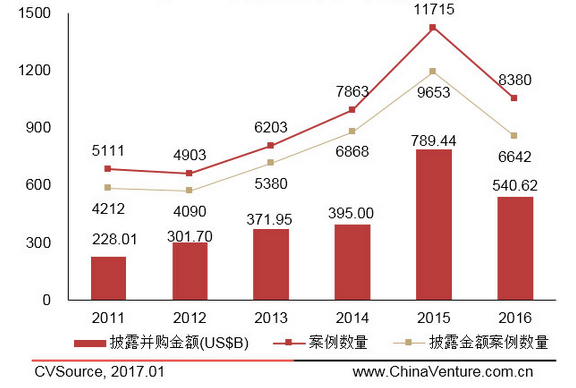

There were 6,642 announced M&A deals in China with disclosed aggregate transaction value of US$540.6 billion in 2016, down 31% and 31.5% year-on-year respectively, according to data released by Chinese deal tracking firm ChinaVenture.

A total of 4,010 M&A deals with aggregate transaction value of US$253 billion were actually completed in 2016, down 23% and 26% compared to 2015, respectively.

Announced M&A Deals In China From 2011-2016

(Bars represents aggreg... This news article comes via , who is the copyright owner of this information and news. FintekAsia.com has licensed the rights to this article and any republication or re-distribution in whole or in part of this content is strictly prohibited without the express consent of China Money Network