There are many precedents of financial systems experiencing significant asset deterioration following sustained periods of above-trend credit growth.

In China, there have been a rapid build-up of credit in the 1990s, with over-leveraged Chinese state-owned enterprises weighed on predominantly state-owned banks reporting non-performing loans (NPLs) of about 30%, much of which were subsequently carved out in a state-sponsored restructuring process.

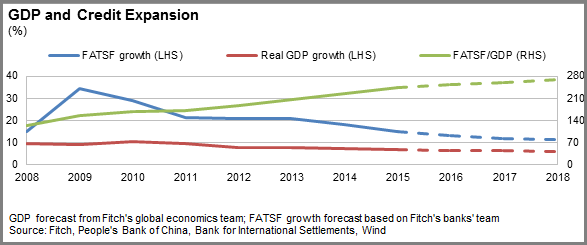

In the recent past, China's double-digit credit expansion, far exceeding GDP growth, means leverage continues to rise. Adjusted total social financing was 243% at end-2015, almost double that at end-2008, and could hit 269% by end-2018, Fitch Ratings forecasts.

Leverage, which is greatest in the corporate sector, is contributing to market volatility and discouraging private sector inve...

This news article comes via , who is the copyright owner of this information and news. FintekAsia.com has licensed the rights to this article and any republication or re-distribution in whole or in part of this content is strictly prohibited without the express consent of China Money Network