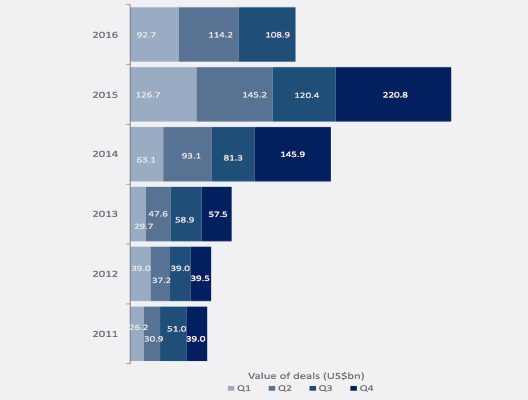

Mergers and acquisitions targeting China and Hong Kong slumped to US$108.9 billion in total deal value during the third quarter, the second lowest level since the fourth quarter 2014, according to a new MergerMarket report.

Similarly, M&A value during the first three quarters dropped 19.5% year-on-year to US$315.8 billion from US$392.3 billion, driven by a dramatic inbound deal decline to US$6.6 billion from US$30.9 billion last year, and a 14.4% drop of domestic M&A activity.

Industry consolidation among state-owned enterprises remains a strong driver of domestic Chinese M&A. China Petroleum Capital’s US$11.3 billion spin-off to Jinan Diesel Engine and the US$8.7 billion merger between Wuhan Iron and Steel and Baoshan Iron & Steel were the biggest deals.

Take-private transactions of overseas listed Chi...

This news article comes via , who is the copyright owner of this information and news. FintekAsia.com has licensed the rights to this article and any republication or re-distribution in whole or in part of this content is strictly prohibited without the express consent of China Money Network