As China's economic and financial influence on the rest of Asia has grown in recent years, some of U.S. President Trump's hard-line economic policies on trade and currencies could have a far-reaching impact on the rest of Asia, even if they are designed to affect only China-U.S. relations, says a report published by AXA Investment Managers.

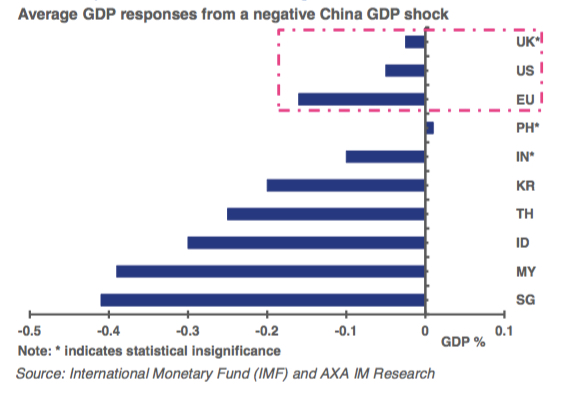

The asset manager estimate that a one percentage point decline in China's GDP could lower Asia's growth by up to 0.4 percentage points. A decelerating Chinese economy would also impact developed economies such as the U.S. and U.K. as well.

China is the world's second largest economy and trading nation, commanding 15% and 11% of global GDP and trade, respectively, up from less than 3% some twenty years ago. In Asia, China’s dominance is even more striking, reflected in its 32% and 45% shares in the region’s trade and GDP.

Apart from its vast economic size, China has also become a key source of financial market volatility. This channel of influence has grown markedly following the global financial crisis, and particularly since mid-2015 following the liberalization of the RMB. Today, the forex market is a powerful propagator of China risks, so any large moves in the RMB can generate sizable spill-overs across Asia and beyond.

As Asia’s largest export market, trade remains the dominant link connecting China and other countries. Gross exports to China accounted for almost 30% of Taiwan’s GDP, followed by Malaysia at 18%, with Korea, Singapore and Thailand all shipping more than 10% of GDP worth of goods to the Middle Kingdom.

A slowdown in China's economic growth and the country's effort to re-balance its economy will have a tangible, but uneven, impact on emerging markets in Asia, depending on the size and nature of each country’s exposures.

Besides trade, China can also affect the rest of Asia via growing financial connections. The chart below shows emerging market Asia’s exposure to China via bank lending, direct investment and portfolio flows. The chart combines the numbers of China and Hong Kong, as the latter often serves as an intermediary to facilitate transactions between China and other countries.

Singapore, being a regional financial hub, is also heavily exposed to China through portfolio investment. Taiwan has been an early investor in mainland China, building a significant manufacturing base, and its exposure via direct investment is sizable. The same goes for Korea, whose direct investment in China accounts for almost 4% of GDP. Thailand’s absolute investment is small, at US$16 billion, but relative to GDP, the share is almost as large as Korea’s. India, Indonesia and the Philippines, by comparison, have relatively small financial connections with China.

In addition, China accounts for more than 50% of demand for some industrial metals and its economic slowdown in recent years have depressed the prices of these commodities. The chart below decomposes the drivers of commodity price movements, based on their correlations with industrial activity in China and the U.S. The result confirms China’s out-sized contribution of above 50% to the market slump since 2014.

As asset prices become more correlated between China and the rest of Asia, the dominance of the U.S. will gradually give away to a dual influence, whereby both the U.S. and China exert their appropriate weights on the Asian market.

For a developed market investor, this means avoiding China will become increasingly difficult and as the Asian market gradually "decouples" from the U.S. and "couples" with China, the diversification benefit for developed market investors will rise, the report concludes.