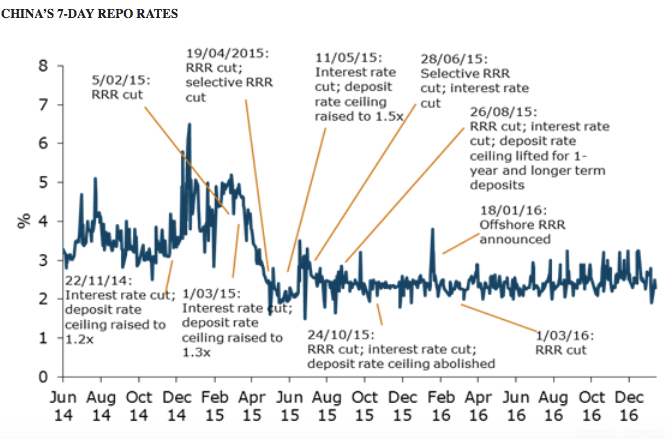

The People's Bank of China repriced the cost of short-term funding by raising the 7-day reverse repo rate by 10 basis points to 2.35% from 2.25% previously, indicating policymakers are inclined to take a more flexible interest rate regime going forward, says ANZ AG in a research report today.

Today’s action is significant as the 7-day reverse repo rate was kept at 2.25% since October 2015 and represents the first major change for over a year. It suggests the Chinese central bank is switching from maintaining a prudent monetary policy for the past 14 months to take a more flexible and fluid policy stance.

ANZ said that it would stick to its call for a prudent monetary policy stance in 2017, but needs to reinterpret the latest policy actions and watch closely for the central bank's next moves.

The Chinese central bank's action seems to focus on preventing a cash crunch amidst deleveraging and deflating financial bubbles in certain sectors. Going forward, it will continue to focus on establishing a yield curve with interest rate risks tilted towards the upside, ANZ forecasts.

(Image credit: ANZ AG)