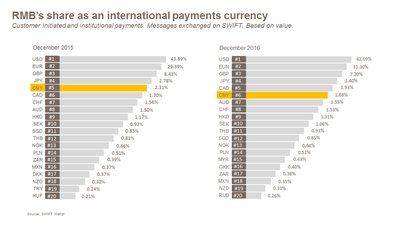

Society for Worldwide Interbank Financial Telecommunication (SWIFT) says that the payments value for RMB decreased by as much as 29.5% in 2016, while the Chinese currency's share as an international payments currency dropped from 2.31% in December 2015 to 1.68% in December 2016, signaling that years of currency internationalization efforts stalled last year.

The People's Bank of China focused on fighting against depreciation pressures on the currency and keeping the RMB's value stable last year. RMB payments value decreased by 15.08% in December 2016 compared to November 2016, whilst overall, payments value for all currencies increased slightly by 0.67%.

"The decrease in RMB usage for payments in December may be attributed to a convergence of several events: the slowdown of the Chinese economy, the volatility of the RMB exchange rate and regulatory measures on capital outflows," says Michael Moon, head of payments markets Asia Pacific at SWIFT.

The RMB closed out last year in sixth place among currencies used for international payments, down from fifth place in 2015, SWIFT said.

Despite the slowdown, RMB internationalization will continue to benefit from major financial infrastructure milestones, such as China International Payment Service Corp. for cross-border clearing and a forthcoming RMB offshore center in the United States, he adds.

Payments sent and received by value, including RMB's share and rank as International payments currency

RMB's share as an international payments currency. Customer initiated and institutional payments based on value.