China is the world’s largest financial technology market, with a market size greater than US$1.8 trillion in 2015. In addition, it is a global leader in every aspect, including market structure and user habit.

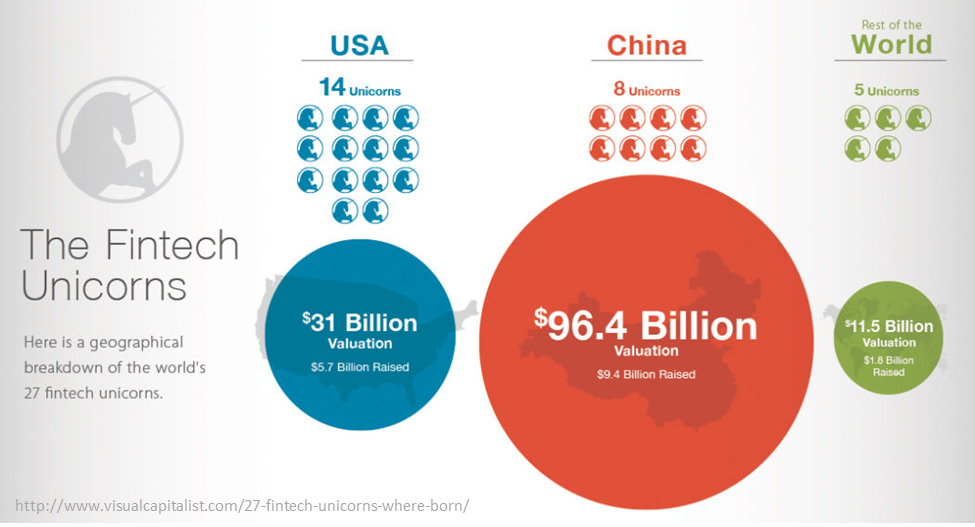

Out of 27 Fintech unicorns globally, China's eight Fintech unicorns have raised US$9.4 billion in funding and have a combined valuation of US$96.4 billion, according to a report released by entrepreneur Gaurav Sharma.

The four biggest Fintech unicorns in the world are Chinese: Ant Financial (US$60 billion), Lufax (US$18.5 billion), JD Finance (US$7 billion), and Qufenqi (US$5.9 billion).

The drivers behind advanced Fintech market in China include China’s transition into a consumption economy, high mobile Internet penetration, a large e-commerce ecosystem, unsophisticated incumbent consumer banking, large under-banked population, accommodative regulations and more than US$7 trillion of investable wealth.

BAT (Baidu, Alibaba and Tencent) dominate China's Fintech market, and are at the core of China’s Fintech revolution. They dominate China's Internet ecosystem and generated US$39 billion of revenue for the 12 months ending June 30.

BAT enjoys "unfair advantage" over incumbent banks and other players due to proprietary third-party rails and voluminous transaction data sets.

Alibaba, for example, has more than 420 million customers who have provided the company with behavioral data for years. In comparison, National Credit Bureau, run by People's Bank of China has data on only 300 million people, less than 25% of the total population.

Mobile payments are also at an all-time high. China has 380 million people shopping online via their phones, as well as nearly 200 million people using their phones as a wallet for in-store payments.

The sort of innovation that is happening in China is much more sophisticated than any developed market. Tech and platform companies with transactions data and proprietary "rails" are winning the game.

The BAT companies control about 80% of the Chinese mobile payments market. Alibaba's Alipay takes about half the market, and Tencent's Caifutong takes nearly a fifth.

On the other hand, domestic incumbent banks continue to struggle with their relatively undeveloped systems. The biggest Fintech startups are in payments and lending, which account for nearly 80% of the combined value of all unicorns.

There are three main players in payments: UnionPay, Alipay, and Tencent, each taking 20%, 50%, and 15% of market share, respectively. Alipay processed around 70% of all mobile payments in the country and three times as many transactions as PayPal did in 2015.

Over 800 million people use Tencent’s various applications for daily communication and payments and wealth management. Baidu's RMB3 billion big-data based mutual fund was sold out within three days of launch in 2014.

Ant Financial's Yu'e Bao is now third largest money market fund in the world with around US$125 billion assets-under-management, all in a span of three years.

Other leading players are Tencent’s Licaitong and specialized wealth management firms such as Noah and Hang Tang.

China is also the world’s biggest P2P (peer-to-peer) lender. In 2015, registered P2P lenders originated around US$60 billion consumer and US$40 billion business loans.

Between 2012 to 2015, there was a huge spike in P2P lending due to the dual financial and monopolistic banking system and pent-up demand by borrowers and lenders.

Lufax is the largest P2P lender, with a valuation of US$18.5 billion. There is also Jiedaibao, which is backed by JD Capital.

Around Jan 2016, there were 4,500 P2P platforms in China with 50% of them facing frauds, high delinquency, or liquidity issues.

Weak P2P platforms are dying out slowly and this wave of "cleansing" and "consolidation" is likely to continue for the next 12 to 18 months.

Although regulatory scrutiny is increasing, Chinese officials have thus far been more liberal than other markets. Chinese regulators are easing restrictions that currently hamper commercial banks' investment into technology enterprises.

China is also planning to develop a far-reaching social credit system by collecting information online and providing all its citizens a score.