There are many precedents of financial systems experiencing significant asset deterioration following sustained periods of above-trend credit growth.

In China, there have been a rapid build-up of credit in the 1990s, with over-leveraged Chinese state-owned enterprises weighed on predominantly state-owned banks reporting non-performing loans (NPLs) of about 30%, much of which were subsequently carved out in a state-sponsored restructuring process.

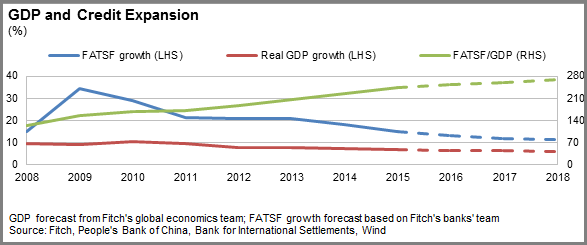

In the recent past, China's double-digit credit expansion, far exceeding GDP growth, means leverage continues to rise. Adjusted total social financing was 243% at end-2015, almost double that at end-2008, and could hit 269% by end-2018, Fitch Ratings forecasts.

Leverage, which is greatest in the corporate sector, is contributing to market volatility and discouraging private sector investment. Slower economic growth risks exacerbating any financial system stress.

Official commercial bank non-performing loan ratios were 1.8% during the first half this year, but asset quality data in China is not representative of the magnitude of underlying problems.

Quantifying the extent of China's bad debt is difficult due to limited transparency, including inconsistent standards of loan classification and impairment recognition.

Instead, Fitch looks at loss-absorption capacity based on three core assumptions: inefficient credit; impairment rates of 35% and 50% on inefficient credit; and a 70% loss rate.

Comparing pre and post 2008 incremental GDP contributions from CNY1 credit and excluding local government debt, Fitch estimates about 56% of the credit increase since 2008 may have been inefficiently allocated and risks impairment.

Assuming losses are recognized upfront, it wou

ld yield a NPL ratio of 15% to 21% and a one-time capital gap of US$1.1 trillion to US$2.2trn, or 11%-20% of GDP, Fitch estimates.

Going forward, assuming leverage continues to build at current rates to end-2018, and problem debt is not resolved, the capital gap could widen by 10 to 13 percentage point of GDP.

At the present, problem credit is being gradually managed via growth, using existing buffers supplemented by further capital raising, as well as via restructuring, disposing and writing-off loans, and debt/equity swaps.

Fitch expects this to continue with China resolving problem credit over time rather than through upfront asset carve-outs.

More debt, including corporate sector debt, is likely to migrate towards the sovereign balance sheet beyond that of local government credit.

(All images are from Fitch Ratings.)