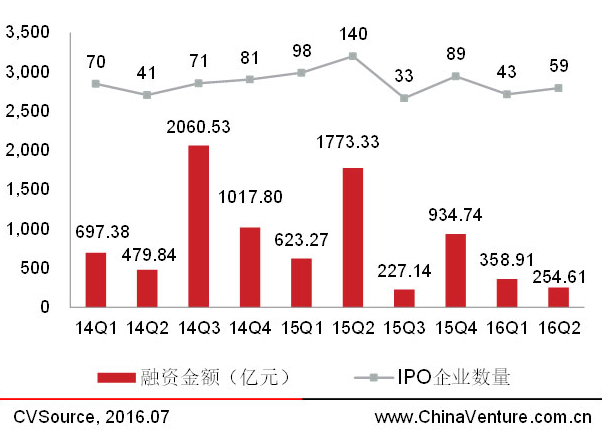

The IPO market remained tough during the second quarter, as 59 Chinese companies completed initial public offerings globally during the past three months, down 57.86% year-on-year. Aggregate fundraising from these IPOs reached RMB25.5 billion, down 85.64% year-on-year, according to data from ChinaVenture.

(Bars are total fundraising value and dots are numbers of IPOs)

Thirty-seven Chinese companies completed IPOs on the domestic A-share market, while 19 floated in Hong Kong's H-share market and two was listed in the U.S. One company made its debut on the Australian Stock Exchange.

These IPOs allowed 49 private equity and venture investors to exit, as 13 Chinese companies were backed by these private investors. The investors generated an average return of 1.68 times of investments, down 33% year-on-year and 78% quarter-on-quarter, according to the report.

(Bars are total book value return in RMB100 million unit and dots are average book value return multiples.)

In terms of industry, manufacturing companies raised 37% of the aggregate fundraising via these IPOs, followed by transportation and financial services firms.

BOC Aviation Ltd. was the largest IPO by a Chinese company during the second quarter, having raised HK3.7 billion by listing on the Hong Kong Stock Exchange.

The global IPO market faced tough conditions as well, as all IPOs around the world raised US$22.5 billion during the second quarter, down 56% year-on-year, despite the number having doubled from the first quarter.